Analysis: Out With The Old, In With The New

Analysis: Out With The Old, In With The New

By John Swartz

The board of the Orillia Power Corporation made its annual trek, figuratively, to Council for its annual general meeting last Monday. This time it was conducted by video conference.

For 20 years it’s been a bit of a love fest because even when some part of the recap of the previous year’s business experience fell short it was usually not by much and there was still good news in the form of a dividend payment to the City, which combined with the annual interest payment on the City’s $15 million initial investment in OPG made for total payments hovering around the $2 million mark.

![]()

Circumstance being what they are, the distribution subsidiary being sold to Hydro One, and the necessity of a corporate restructuring because of that, the dividends were almost astronomical, and next year the AGM will be conducted by the board of the Orillia Power Generation Corporation (OPGC)

What most people want to know is how much money was paid to the City from the 2020 business year. The sale of the distribution company resulted in a $26.3 million dividend, repayment of the portion of the $15 million investment mentioned above amounting to $9.8 million and a dividend equal to the value of land transferred to the City of $3.6 million (OPC properties not required by Hydro One were purchased by the City; OPC declared a special dividend to the City equal to the sale price and the City paid that back to OPC to complete the sale, which effectively was a bookkeeping exercise and no money really changed hands).

The 2020 regular dividend to the City was $1.2 million. Combined with other payments (solar leases and interest on investment payments) the total cash amount the City received from OPC is $35,639,000.

The end of year dividend, based solely on operations and excluding the distribution sale, payable to the City August 31 is $900,000.

And with that OPC ceases to exist and the company goes forward as Orillia Power Generation Corporation (OPGC).

There were other developments in 2020. OPC was partnered with Shaman Power to build a new generating station at Bawatik (near Peterborough). One of the first acts the new Ontario government took in 2018 was to cancel over 700 pending power generation construction projects, including Bawatik. The OPC took a little more than a $2 million write-off for the 2019 fiscal year.

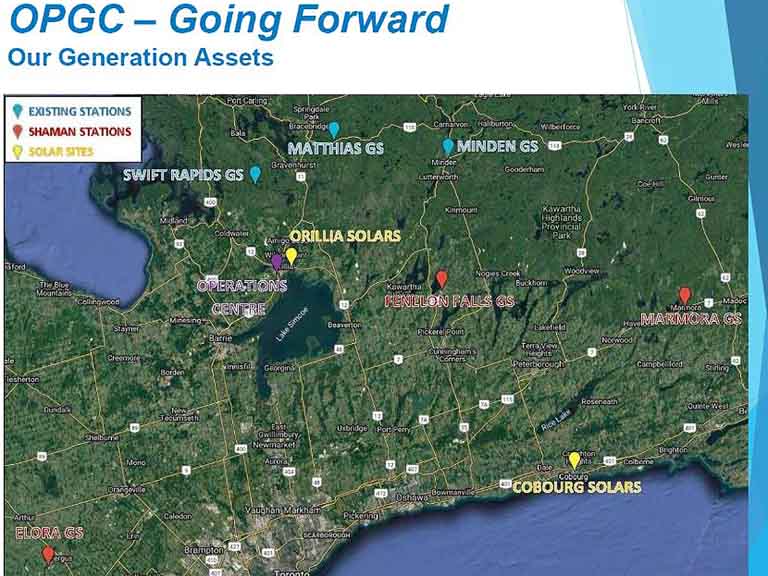

Subsequently, OPC bought Shaman Power in October 2020. Shaman owned three generating stations, and both jointly owned the land at Bawatik. The ownership transferred to OPGC who is now the 100% owner of 6 generating stations, 7 solar generating plants and the land at Bawatik.

The purchase details are interesting. OPC paid $2.5 million in cash for all outstanding shares valued at $11 million. Part of the full value, $8 million was encumbered by loans Shaman held. OPC took over the debt and payments to gain 100% ownership.

Councillor Tim Lauer asked for clarification about a note in the financial statement referring the ownership.

“If I‘m remembering correctly we are the owner of two leases and one out and out purchase of a facility in Elora?” Lauer asked.

“Technically we own all of the three stations. Each of them is slightly different terms, but they each have an option to purchase on certain terms at some point,” said OPGC board chair, Greg Gee.

Further details of the transaction are, the previous owners of the land the three stations were built on have a clause entitling them to buy back the land (and buildings) at the end of the license agreements to sell electricity into the network (2033 for the Mamora station, 2029 for Fenelon Falls and 2057 for Elora). Two things could happen on those dates, not taking the options to buy, or if they are, in steps according to the year of license expiry and at market value. This means OPGC has then benefit now of the full amount of electricity sales, and will be paid, presumably, much more than the market value at the time of original purchase (higher land values and for value of the stations).

Adding the output of the three new stations (4.6 megawatts) brings OPGC’s capacity to 20 megawatts. The OPGC’s solar generation plants add another 2,470 megawats to the mix.

As for the Bawatik land involved in the purchase, OPGC intends to hold on to it for now in case there is a change in policy at the provincial level and the OPGC can build the generating station. The contract was cancelled one month before the start of construction, so all hurdles, permissions, designs and blueprints were in hand and restarting will be relative easy. Lauer asked what the process would be if the station is to be built.

“Does that kind of a decision come to council or do you guys do that independently?” Lauer asked.

“We would just look at that as an operating decision. If we were to go ahead with something there, we would definitely be coming back to council,” said Gee. “We are just trying to make a business decision as to continuing to own the property, what it costs us to carry it and whatnot, how does this – out of our income – relate to the carrying costs and what are the prospects, what are we hearing out in the marketplace in terms of any new water power licenses being granted – that would be the key trigger. If we got wind there was a possibility of getting a license we would definitely be coming back and talking to council about that.”

![]()

Gee ended his presentation with a cautionary message.

“I just want to give you a heads up. We are having a very difficult water year this year, which probably won’t surprise you, (it’s) probably one of the worst we can remember. As of the end of May we are more than $1 million behind budget in terms of revenue,” Gee said.

“The year, of course, is not over. Summer is not normally a good time for us and certainly this summer is not proving to be. The fall and November, December can be very good months for us, so we’re not giving up on the year, but it would be quite a development to earn back a million dollars. I don’t think our story, when we come and see you next, year is going to be nearly as happy.”

Barring a change in the weather, that means dividends to the City from OPGC operations in 2021 will likely be lower, but interest payments will remain according to previous levels, but on the remaining $5.2 million investment the City has remaining in the company.

All that said, even if the weather changes and normal returns happen, payments will be lower because the distribution contributions to the bottom line do not exist anymore. The City’s investment of sales proceeds from Hydro One in the Legacy Fund are intended to generate enough interest to replace the amounts the distribution company contributed to payments to the City, and in the end add up (OPGC payments plus Legacy interest) to the approximately $2 million received annually.

(Photos by Swartz – SUNonline/Orillia; Images Supplied)