Your 2021 Property Taxes

By John Swartz

Orillia council will be debating the 2021 budget in November. Last week they held a budget committee meeting, mostly for staff’s benefit. The purpose was to give direction regarding the kind of budget council wants presented in the fall.

Every year this is an opportunity for council to say go ahead, including some new item, change some policy or previous direction – and most important, keep the bottom line number to some level.

![]()

From staff perspective, it’s a chance to remind council of some things council already approved which will affect the next budget, suggest some things staff believe should be considered which might affect the bottom line (e.g. the province says we now have to do X, that’s going to cost Y, if there is no increase we have to cut something, what do you want us to cut, or do we keep it all?), and of course, what’s the stomach for a budget increase beyond inflation?

Every year the budget goes up by at least 2 percent just to account for inflation. Anything above that generally means council is spending money on new things or extra service.

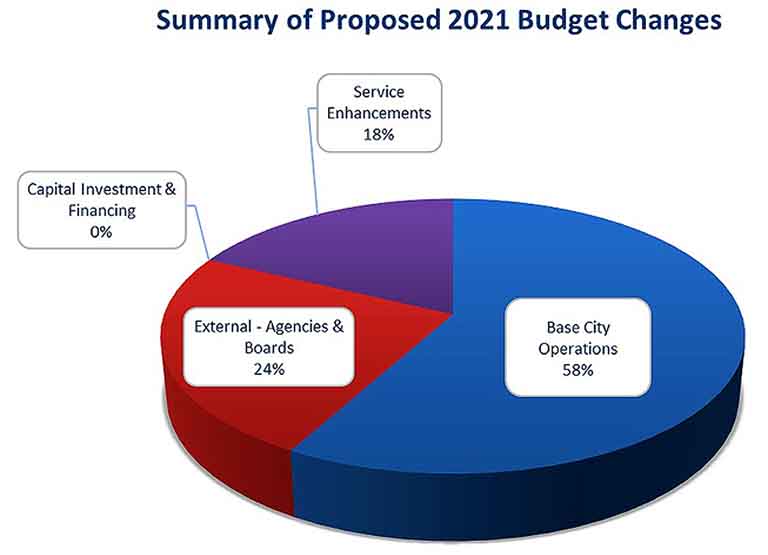

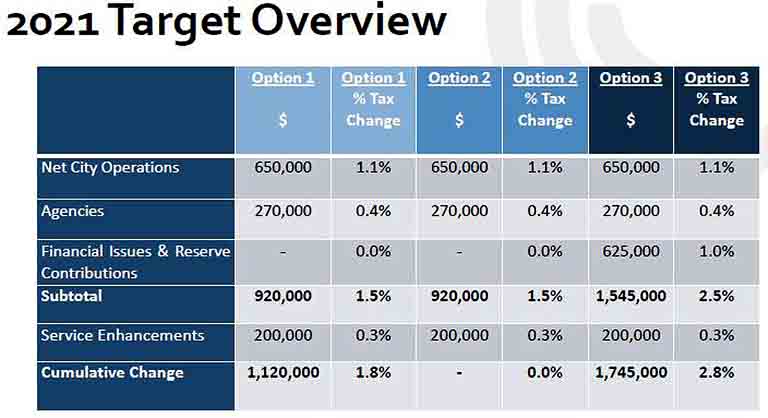

Staff is proposing a budget of $62.4 million, which includes a 1.8% increase and they presented council with three options how to achieve the number.

Where Each Budget $ Goes

The difference between option 1 and 2 is where the money comes from for the increase, the tax levy (your tax bill), or reserves ($1.2 million). Both recommend no increase to contributions to reserve accounts. Since 2015 council has been increasing reserve contributions annually to repair damage to balances previous councils have made in bits and bites. Effectively these two options are stalling any reserve increase without eliminating contributions.

The third option allows for the reserve contribution increase and does not use a tax rate reserve contribution, meaning tax bills would go up 2.8%. There was no discussion by councillors of this option, even though City treasurer Jim Lang said each was workable.

“I would never bring forward an option that is not viable,” said Lang. “Given the significant work council has done in the last 6 years on reserves, specifically the tax rate stabilization reserve, makes option 2 a viable option – not without costs, but a viable option. I do not believe council has to take drastic steps to be able implement any of the options in 2021.”

There was much discussion about the merits of each, and questions about effects if one thing or another was done or taken into account. A good portion of the time was spent feeling out what might happen in 2021 if the pandemic isn’t over and the economy gets worse – how will that effect taxes going into 2022, and how will people pay any tax next year.. Finally Mayor Steve Clarke said it was time to put a motion so council would have something concrete to further discuss.

Councillor Ted Emond moved the second option.

“With respect to the worst case scenario happening we have two (issues),” Emond said. “The difference in economics between 1 and 2 is hardly relevant. If that (worse economy) does happen, all levels of government are going to be faced with a huge challenge. At that point we will be looking at dipping into, not only our tax stabilization reserve, but other reserves we have in order to maintain this community.”

“We need to invest now,” he said. “The point is it’s symbolic, that we as the leaders of this City are demonstrating to our community we understand the pain they have suffered, we understand the losses that our businesses have and we are not going to compound that as you struggle both individually and as businesses to come out of this recession next year. So 2021 is an absolutely critical year and we have to do everything we can, both symbolically and in reality to support those businesses.’

Ralph Cipolla seconded the motion. He also called for a recorded vote, but everyone involved seemed to have forgotten and when the vote took place polling of each councillor did not happen.

“This is just a direction for staff,” said Cipolla. “Come November when we get down to the nitty gritty and have all the information at our disposal we may be able to say let’s go for .5, .7, whatever in order to accommodate some of the stuff we want to do. I think we’re up in the air right now to see what the province is going to do within the next 2, 3 months.”

The ramification of taking money from reserves now to cover an inflationary increase is not a one-time affair.

A simple analogy is, let’s say the budget is $100 (this represents the 2019 final budget) and the inflationary increase is $2 (or 2%) making the final 2021 budget $102. Option 2 means, the additional $2 is taken from reserves and the rest is spread among all tax payers and there’s your 2021 tax bill – which bottom line is theoretically the same as the 2020 tax bill.

However, in 2022, the base budget is now $102. The inflation factor adds another $2, so now the final budget is $104. The $2 from 2021 suddenly appears on your tax bill along with the inflationary increase of $2 for 2022, making a total increase of $4, or 4%.

Council, based on their desire to repair reserve account balance (there are many reserve accounts beside the tax rate stabilization reserve), would feel pressure to replace the amount used for 2021, meaning a higher tax increase than just 4%. They do have the option to spread the replacement out over several years instead of all at once.

Councillor Tim Lauer made a good case for not adopting option 2.

“I won’t be supporting this. I think it’s really important to realize and recognize this 1.8% increase is not discretionary. It’s not things we want to do or choose to do. These are inflation increases; they are wage increases that are already negotiated. There’s no way around them and if you don’t pay them this year, you are going to pay them next year.”

“I understand how that may be a symbolic motion maybe a political motion, but I think good money management is represented in option 1 .”

“We can react in November when we get there, but in the mean time we are not handcuffing ourselves in the future because this will have to be paid somewhere along the line.”

“When we get to November if indeed things have changed, we can always react, but if they haven’t we will set the stage going forward and be in a much better situation than otherwise. And I think if we are looking at sending messages to the business community and the taxpayer in general, the message we are continuing to be good money managers is very important,” Lauer said.

Councillor Mason Ainsworth put his support behind Option 1 as well.

“Obviously we can change that direction down the road when we do get to November and do get to the actual budget, but I think setting that up for the future is important.”

‘I know if we are willing to zero that increase it’s going to be a lot more down the road. If we look at the statistics of past budgets when it comes to an election year, usually folks who are on council don’t want to put up the taxes too much during an election year, so that could complicate things down the road,” said Ainsworth.

Councillor Jay Fallis wanted to move a compromise of 1%. This would mean tax payers would see that much increase on their bills, and the rest would come from reserves to be paid later. Ainsworth seconded the amendment to get discussion on the point.

Of course, budgets are merely plans and not set in stone. Accountants and often elected officials will hold fast to the notion budgets must be met in every way (which is how end of year spending sprees became a thing for a while – using up the money allotted instead of having a surplus just so the next budget doesn’t get chopped), but circumstances can happen to make the plan obsolete. We are seeing the realization of how flexible, or how inadequate budgets, can be with the infusion of $1 million from reserves this year for emergency expenses.

Councillor Emond made an argument for defeating the amendment and sticking to how option 2 was read.

“That’s a function of the way we budget. It’s not a function of our need to replenish it in 2022. My view is if we invest from the tax stabilization reserve, we could replenish that over the next 5 years if that were the decision of council,” Emond said.

“We’re in effect, in the short term, borrowing a little bit from our future in order to get to our future in a healthy manner.”

![]()

Mayor Steve Clarke said he could support either Option 1 or 2, but seeing how the discussion was going, was prepared to favour 2.

“I do believe it’s important to send a message to our citizens we do understand what has happened to our economy and by extension to our citizens,” Clarke said. “I do see either option, but certainly option 2, as an investment, materially and symbolic.”

There is a reason for the reserves and it appears now is the time to be glad to have them.

“The tax rate stabilization is indeed our rainy day fund. This is a rainy day and quite frankly I’m having a hard time imagining the rain falling any harder or any longer than it has,” said Clarke.

As it stands, staff will be preparing a budget with a 1.8% increase, and factor in a reserve contribution so tax bills stay the same as 2019. That’s the goal. In November we’ll see if they can do it, or if economic changes nobody knows about now will have an effect.

(Photos and Images Supplied)