Budget Meeting Preview

By John Swartz

Orillia council’s 2:45 p.m. budget committee meeting will result in surplusses being allocated and tax rates being set for 2021.

The City’s new treasurer, Lockie Davis, reports that the province has once again delayed implementing new property valuations which were suppose to be in effect last year, and the old, indexed, values will prevail to 2022. This means the assessments applying in 2020 will be the ones used for 2021, unless there have been changes to a property like new construction, improvements or tax appeals.

The province also adopted a new small business class, which means small business properties would get a discount from the commercial levy. However, it’s not in effect yet and the Municipal Finance Officers’ Association of Ontario objects on a number of points. One being the implementation is being rushed without proper analysis, could create animosity between business that get the discount and those which don’t, and another, it leaves too much guess work for municipalities to understand how tax revenue will be affected. Orillia already has two commercial tax classes, new regulations would make three. The province has indicated they will subsidize to some extend negative effects of the new regulations.

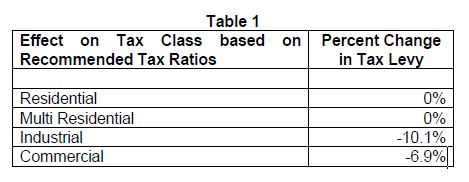

Council will consider keeping tax rates the same as last year when they adopt new ratios. The effect is a 0% increase for residential and a decrease for commercial/industrial properties. The decrease is a result of the province shifting education taxes away from commercial/industrial properties to residential.

Money In The Bank

The result of the 2020 fiscal year is very positive. The City took in $5 million more than it budgeted ($89,000,000). As usual, surpluses are earmarked to reserve accounts. The proposal is:

- $378,994 to water reserves

- $500,000 to a new IT capital reserve

- $1,000,000 to the Major Capital Facilities Reserve

- $1,000,000 to the Land Acquisition Reserve

- $2,150,511 remaining to the tax rate stabilization reserve

The pandemic accounted for a substantial part of excess revenue, they saved almost $1.5 million on salaries. The city also got $1.3 million in property tax mostly because of construction, a $475,000 grant to offset lost tax on Spencer House, the City saved $612,00 on recreation operations, winter costs were down $574,000 and the bill for county services was down $651,000.

The province also made a COVID grant of 1.7 million, which only $278,000 was used, but provincial direction is anything not spent in 2020 has to be used for the same purpose in 2021 if needed, and apparently it will be needed.

The City also received a COVID grant for transit of $660,000, but could only spend to the maximum of the transportation part of the tax levy. The balance of $166,000 is in a reserve for transit equipment.

Other Operating Budgets

Water in and out are separate budgets and there was a greater than budgeted surplus of $373,000. The COVID grant above was used to offset losses in the parking operating budget, $200,000 is still going to the parking reserve.

There were 276 capital projects in 2020 with an overall budget of $37 million. Of that 79 were completed under budget and $1.6 million is going to reserves. 197 projects are still ongoing and the accompanying budget allocations were bumped forward to 2021.

The City got a net total of $36,054,640 from the sale of Orillia Power Distribution to Hydro One. Staff are still working on the investment plan.

![]()

Reserves

The overall picture of all reserve funds is good. 2020 started with a $13.8 million deficit and ended with a $5 million surplus. This means, generally, we are back in the black.

However, three reserve accounts are in deficit of $63 million, they are the land acquisition, major capital facilities, development charges. If those reserves were at zero each, then the total surplus would be $68 million, not $5 million.

This is a public meeting, but Rogers TV will not be carrying it. A video will be available later.

(Photos by Swartz – SUNonline/Orillia)