Council Preview

By John Swartz

A hotel tax may be coming to Orillia. Monday’s 2 p.m. committee agenda includes a report from the chief administrative officer, Gayle Jackson, recommending council approve a 4% tax on hotel accommodations and other short term accommodations like Airbnb to take effect April 2020.

It is known as the Municipal Accommodation Tax (MAT) and form part of a subtotal the HST applies to (so, taxing a tax). This is possible because of legislation from May 2017. Half of the tax amount collected must be given to a local tourism group, in this case Ontario’s Lake Country and used for promoting and developing tourism (i.e. not for general administration expenses or other functions).

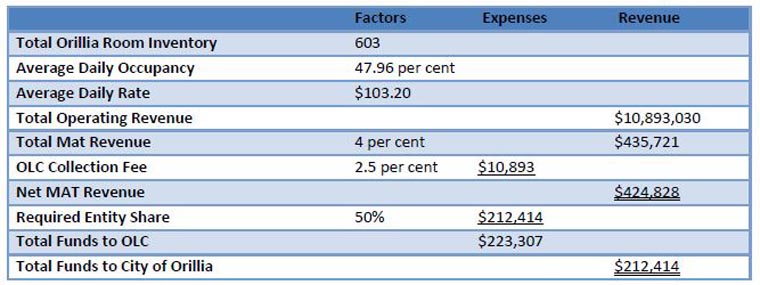

Based on calculation derived from total number of rooms, average daily occupancy and average room rates staff estimate $424,828 could be realized with the City and OLC sharing 50% each – after a tax collecting administration fee of 2.5 percent, which OLC would get for being the tax collector.

Municipal Accommodation Tax projected revenue

The City currently grants OLC $20,000 annually toward their operating budget, this would be eliminated from the City’s budget in 2020.

There are some exemptions to paying the tax. Hospitals, other government entities, school boards and post-secondary institutions, and long term facilities will not have to charge the tax. Staff is recommending any group providing shelters (e.g. the Lighthouse) and other treatment centers, campgrounds, boats, those renting rooms for business meetings or for hospitality purposes should also be exempt from the tax.

A second option, for council to create a municipally owned tourism marketing operation, is not recommended by staff for several reasons, start up costs and council not being able to control such an organization directly among them.

A number of groups were consulted regarding introducing a MAT (Oro-Medonte, Chippewas of Rama, City of Barrie, the County, the chamber of commerce, and OLC), and staff conducted a stakeholder meeting with hotel operators; the report does not indicate any of the stakeholders objected to a new tax.

Included in the report is a chart showing 28 municipalities already have the tax (Toronto, Ottawa, Windsor, Barrie, etc.) and only 6 do not (Midland, Collingwood, Bracebridge, Lake of Bays, Muskoka Lakes and Brantford). Notably, Niagara Falls capped their tax at $2 per room. A letter supporting a MAT from the chamber asserts municipalities without a MAT will fall behind in tourism because they won’t have budgets derived from the tax for competitive marketing and promotion. The chamber also recommended a 70/30 split of revenue and a new tourism board be created.

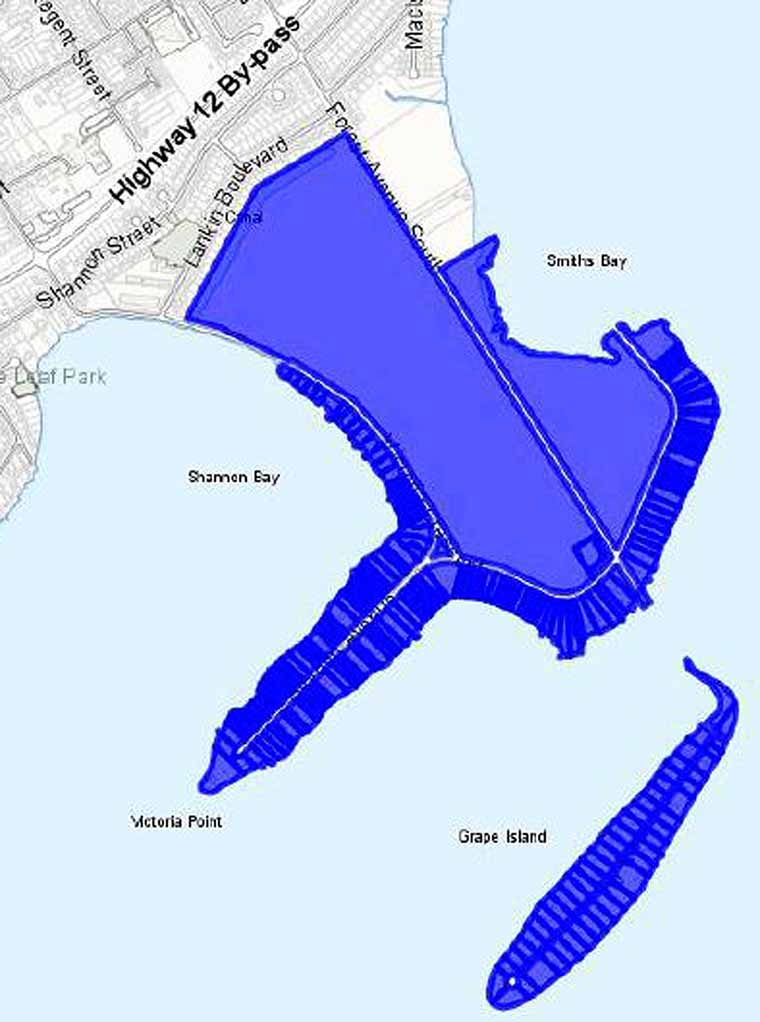

Grape Island

A report for the economic development department regarding progress toward an agreement for use of the Forest Avenue road allowance to Lake Simcoe is on the agenda. In January 2018 council created a working group comprised of three Grape Island residents, three Victoria Point residents and the Ward 1 councillors. Two Grape Island residents resigned in October citing the inability of Grape Island residents to reach consensus.

Grape Island residents subsequently hired a lawyer, Christopher Du Vernet, who in advising the City of his engagement, suggested the City and Victoria Point residents also hire legal representation. Victoria Point working group members are concerned the residents they represent cannot afford a lawyer.

Staff recommend the working group be dissolved and they be given authority to conduct a survey of both resident groups with the aim to provide council with a solution to the neighbourhood dispute. Staff also recommend they be prohibited from meeting the Grape Island lawyer without the City’s own lawyer being present. Staff estimates legal fees could reach $7,500.

The central issue is the time available to barge operators to use the road allowance in order to move supplies and service vehicles from the mainland to the island.

Rotary Place Door Failure

Parks and Recreation staff are recommending council approve $80,000 to replace two overhead door systems that have failed several times. $8,000 has already been spent repairing them and $5,000 was lost in 2019 of ice rentals because of the failures. Staff say overhead doors are not in common use in arenas and a contributing factor to the current system is they are used 15 to 20 times a day. Three different companies called in to make repairs recommended the counterweight opening mechanism be replaced with spring operation systems.

Staff is recommending Athletica Sport Systems be hired for the replacement, citing they are industry leaders and have a similar system in place in Port Perry which has operated breakdown free for 17 years.

A second option to hire Canadoor at a cost of $26,000 to repair the current system to original design does not address some safety concerns and is not recommended.

Land Management

The City does not currently have a by-law regulating what property owners and developers can do with soils and are proposing a by-law to do so. Staff is recommending enacting one. This would affect dumping and removing soil, altering grade, regulating hours such activity can be done, haul routes and volumes. Dumping is a big issue in surrounding townships. Developers who commented say fees and design costs will increase the cost of development, maybe significantly.

Home Building

Development services has a report on the implications of the province’s More Homes More Choice: Ontario’s Housing Supply Action Plan (Bill 108), which amends 13 other pieces of legislation.

Staff, relying on a consultant’s report, say the bill will reduce ability to fund growth related capital work by reducing cash flow, and putting more pressure on debt levels and delaying timing for infrastructure placement; make planning more difficult by introducing a community benefits charge to fund soft services; and result in less transparency of land development and create more red tape.

The bill takes the relatively simple development charge component for funding service upgrades resulting from development and creates a range of opportunities to collect community benefits fees at several steps of an application process. Staff say this would potentially increase revenue from new development projects, but reduce revenue from projects already in progress (staff say some applications have been in process for 4 years).

The bill has Royal Assent, but has not been proclaimed yet. Staff say there have not been any regulations issued, so it’s impossible to accurately predict what the financial implications will be. The report’s author, Jill Lewis, provides a long list of changes to various Acts resulting from Bill 108, and under the Planning Act changes the last point seems to be the most significant to residents – removal of the ability to appeal conditions of draft plans of subdivision.

Under the Endangered Species Act, protection for newly listed species is effectively removed and allows the minster to make side agreements with developers to harm species at risk and habitat. Granted, it also allows the minister to stop development relating to species at risk.

Lewis’s list points to a stunning number of conflicting changes in the various acts.

(Images Supplied)