Why Do We Pay Taxes?

Things That Matter, By Dennis Rizzo

Why Do We Pay Taxes

Ben Franklin once said, “The only things certain in life are death and taxes.” The first I can attest to having delayed (for the moment) thanks to the efforts of our health care system. The other remains inescapable – every April 30th our government requires all of us to declare our portion and pay up.

But pay up for what? Why do I pay taxes? What do we get for our outlay? I see a lot of protest, distrust, anger, and resentment in on-line discussions. It is understandable, given that we average humans cannot get our heads around the disjointed and vague explanations reported in the daily news. When we can’t see the results of our efforts (or pay out) we lose trust and faith.

Politicians love to talk about transparency in government. I have always assumed this meant explaining in simple, everyday terms what was happening with our money and, just as important – why. I expect some degree of open discussion of the benefit of public expenditures to the overall population. Unfortunately, looking at the budget (whether federal or provincial or local) is akin to working out a Rubik’s Cube of fiscal minutiae, indecipherable bureau-speak terminology, and accounting slight-of-hand.

So I thought it might be helpful to at least try to look at where our tax money goes and who benefits. Pray for us as we enter the maze.

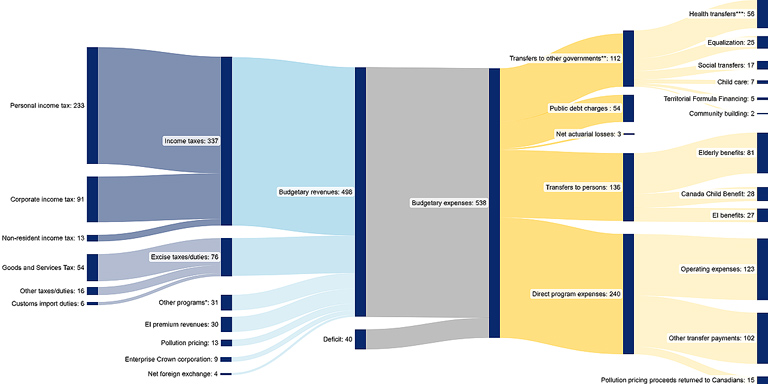

Federal Sources Of Revenue And Expenditures 2024.

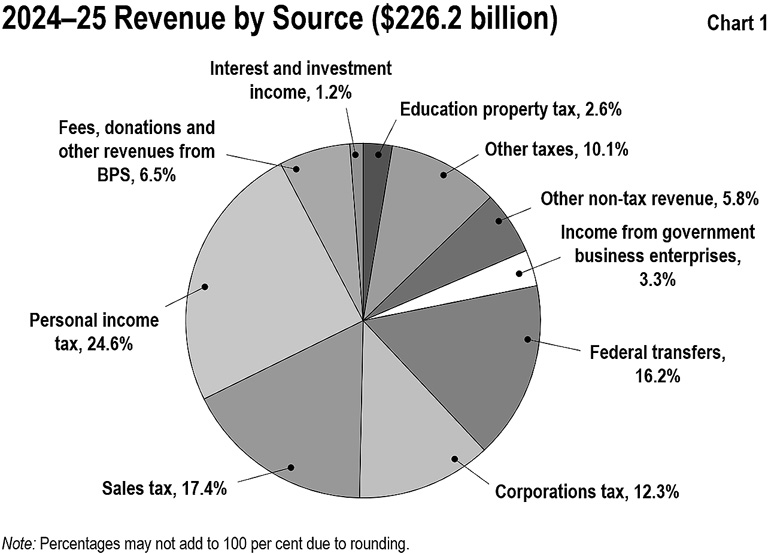

In 2025-26, provinces and territories will receive $103.8 billion through major transfers. This comes to a per capita return to the provinces of $2,407 – or $9,650 for a family of four. This is your tax dollars being sent back to your province for health care, infrastructure improvement, education, and operations, and represents 16.2% of the Ontario budget for this current year.

The concern about the deficit seems to pervade the news and opposition press releases. Should the government have a deficit? I suppose if we all resort to credit to carry our lives forward that would apply to government as well.

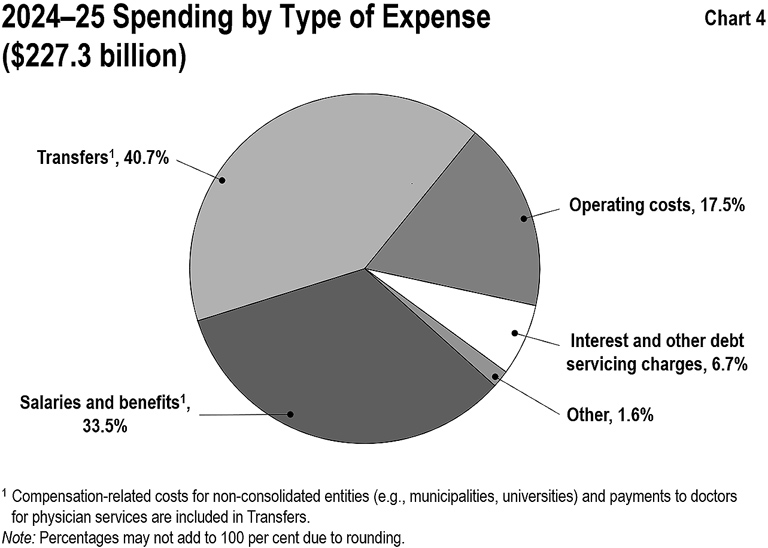

The interest payment for the year was $15.4 billion. That represents 6.7% of the total budget. Most of us who carry a mortgage and pay credit card bills have a greater overall percentage in fees and interest. Should we? That’s for another harangue.

And who gets the interest?

The Audit (a conservative source) notes: most Canadian government debt is financed through debt securities such as marketable bonds, treasury bills, and foreign currency debt instruments. And those bonds and bills are owned by buyers.

Who are those buyers? Many of them are probably Canadian banks and other financial institutions. But as of February 2025, according to Statistics Canada, it was international portfolio investors who owned $527 billion of Canadian federal government debt securities.

Stats Canada notes: Statistics Canada is prohibited by law from releasing any information it collects that could identify any person, business, or organization, unless consent has been given by the respondent or as permitted by the Statistics Act. So we really can’t locate (easily) the exact investors who receive interest payments.

Many investors in government bonds and securities are pension funds, retirement funds, and RRSP funds. Foreign acquisitions of Canadian securities totalled $7.9 billion in January, driven by a $14.5 billion investment in the form of debt securities. Non-resident investors increased their exposure to Canadian bonds by $33.5 billion, the highest investment since April 2020. More than 50% (+$17.2 billion) of the January 2025 investment was in bonds denominated in US dollars. According to Stats Can.

By investing, outside buyers are telling you that your country’s economics are sound and stable. At the same time, many funds are moving away from USA bonds because of instability. So, our government is paying interest to a lot of investors, some foreign, but most local and benefitting all of us. So the idea that public debt is bad depends on where you stand politically, not fiscally.

Back to taxes. You pay tax at a rate of around 20-30% depending on your deductions and income level. The effort to develop the economy has resulted in a continuous decline in corporate tax rates over the past few decades. The federal tax rate for general corporations averages about 15% and the Ontario corporate tax rate is about 11.5%. Accounting and cash flow practices can result in lower actual payments.

Of course, if a corporation is netting in the billions of dollars annually, logic says their tax contribution would be quite a bit larger than yours. Instead, major corporations avoided over $30 Billion in federal taxes through accounting loopholes you don’t have. And there are numerous guides to avoiding tax payment at the corporate level. For example, corporations can deduct losses from up to three years previous. Can you?

Of course, the business community will tell you that it needs to reduce taxes to be competitive. Perhaps. Perhaps not.

It would seem logical that being competitive means you have a product or service that generates customers and income, which, if your business plan is solid, would result in a fair profit. From the profit a portion goes to taxes to cover public expenses benefitting your corporation and employees (health care, education, infrastructure, etc.).

I wonder how much of the money saved in tax deductions are actually put back into the business to generate additional income and create jobs. Or do we too often see corporations simply plowing that cash back to owners, investors, or stock buy-backs?

I’d love to get a tax deduction that I could use to pay off my daughter’s tuition. It would be nice to get a deduction for the interest paid to banks on my mortgage. How about a deduction for investing in my own education to get a better job so I can pay my taxes?

In short – corporations moan and complain about taxes. Yet, many loopholes exist for them to pay little or none.

Conservative pundits want to lower corporate taxes, saying it will generate jobs. Still, 44 years of the trickle down approach has failed to show any lasting results. Money thrown at corporations seems to be distributed to shareholders instead of creating more opportunity. Corporations love to cry about paying taxes, but there seems little hesitation to accept public money when they screw up their bottom line.

All governments seem to be unable to tell us where our money goes in terms someone without an accounting degree can comprehend. We see news reports on some of these expenditures, but never in a way that lets us understand the reasoning behind the expense.

Everyone complains about paying taxes, but no one seems upset when they need to use the services and facilities paid for by those taxes. Perhaps we should see those for what they are – part of our community, an investment in our quality of life.

I suppose, in the end, it comes to a failure of our leaders to keep us in the loop on what the dollars spent return to us in services and living conditions, and for each of us to spend a little time to understand what our dollars cover.

We live in a safe, resilient country. I’ll pay my taxes to ensure it stays that way. Maybe everyone should.

(Images Supplied)

Dennis Rizzo joins SUNonline/Orillia as a columnist writing on big issues affecting ordinary Orillians. He is an ex-pat Yank from New Jersey. Orillia, Ontario. Canada is his adopted home, but he has brought along a degree of puckishness and hubris. Dennis spent more than 30 years working in the field of disabilities, with some side trips to marketing and management. He presented and keynoted for many conferences and served on a President’s advisory committee. Dennis is the author of several journal articles and booklets in the field of disabilities and work and five non-fiction books, including “A Brief History of Orillia – Ontario’s Sunshine City.” He recently republished a novel set in 1776 and a mystery set in 1860. He also enjoys sitting in on music sessions around town when he can.