2024 Budget Meetings Start Monday

By John Swartz

Orillia council begins the 2024 budget deliberations Monday at 1 p.m. The budget schedule breaks down to three major parts and three agenda documents of several hundred pages each.

Broadly, Monday’s meeting is essentially a regular council meeting. Tuesday and Wednesday meetings begin at 9 a.m. and will deal with matters relating to the operating budget. Two more days, November 14 and 15 also begin at 9 a.m. are when council will go over the capital budget. By the close of the day on the 15th, we should know if property taxes will change. Don’t bet they’ll go down or stay the same as 2023.

This 5 day format has been City practice for more than 25 years. Budgets used to be debated and set in January/February, but about 15 years ago council changed to November because staff said with final budget approvals before year end the City would be able to tender projects in the New Year and get better prices then if they had to wait until spring. You may be thinking, ‘but didn’t we just do this in January this year?’ Yes, the first year of every council term features trial by fire with new councils having to do their first budget in January only weeks after being sworn in. This was the case for the 2023 budget.

Monday’s meeting has three items on the agenda. First is the overview of the 2024 budget proposal. Every June or July council has a budget meeting to hear staff’s outlook regarding the next year and to settle some questions about proposals and items affecting the budget staff should spend their time on. Council also sets targets. In June staff informed council the budget could increase from 2.68 to 6.69%; council said keep it under 4%. Council also rejected some items then and directed staff to find alternative proposals for others.

To that end the 2024 budget staff prepared comes with a 1.97% increase. That means taxpayers can expect their bills to go up and average of $77 in 2024. That’s based on the average property assessment in Orillia. Because your property valuation may be different than average another helpful way to understand what your individual bill may look like is each $100,000 of assessment may increase by $27.

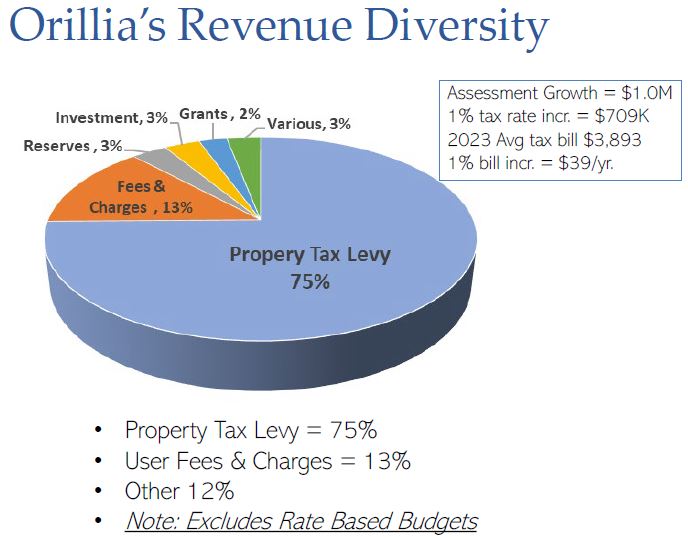

Tax rate increases have been trending down each year from a high of 3.86% in 2016. Property tax assessment accounts for 75% of revenue the City takes in to pay for everything.

John Henry is the City’s treasurer and is ultimately responsible for the budget preparation. For the most part references to staff will mean him.

The overview states most of the increase is because of increases by the County of Simcoe for services the City contributes (ambulance, social housing and welfare, and etc.) of $879,000, and the OPP $531,000.

That means the total budget to run the City of $72.7 million is increased by $1.4 million for just those two items. Overall the entire budget is going up $2.3 million, but new taxation on new property development will bring in $1 million and that money reduces the amount of property tax charged to existing taxpayers. On the latter, the exact amount won’t be known until year end and staff estimate how much based on information from MPAC; year end reconciliations have tended to be more than staff project and any surplus amounts go straight into reserves.

Furthermore, on your property assessment, the province froze assessments in 2020 at 2016 levels. The province is continuing to hold that line for 2024, whatever your assessment was in 2023 is likely not going to change.

There are other outside entities (Simcoe Muskoka District Health Unit, Orillia public Library Board) that submit their budgets to the City for which council is obligated to pay and has very little control over.

Taking those out of the equation, and the County and OPP funding, the Cost of operating all else in the City is only going up $191,000 over 2023.

Another way the projected increase is being kept below 2% is the City changed its strategy on invested funds. This resulted in $500,000 in extra interest income over the previous year. Half of that is put into reserves and half applied to reduce the tax levy. Another way council will reduce the levy is by increasing users fees; for example the cost of passes to use the Orillia Recreation Centre will go up varying amounts depending on the type of pass, (less than $2 for most monthly user classes).

The budgets of the various boards, agencies and committees are going up $95,000 in total. Of that the library budget is increasing by only .08% to $2.7 million. Reducing the total amount comes from transferring the grants committee budget of $32,000 away from the tax levy to be funded from the Municipal Accommodation Tax, so visitors staying in hotels and etc. are covering that cost. None of the amounts to this group of budgets is set in stone and council may reduce or increase line item budgets.

Capital Budget

Discussion of capital budget items will be in the second week of meetings. The overall budget for projects is $70 million – that’s how much will be spent according to plan in 2024. The good news is most of that funding comes from other sources (such as development charges, grants from other levels of government, or reserves accumulated from prior year’s tax levies) than the current year tax levy.

The biggest project is a refurbishment of Brian Orser Arena at $12.4 million. Next is the second phase of the Laclie Street reconstruction at $11 million. On that, council decided to finance the cost of the Laclie Street project and staff say payments will come from reserves and have no effect on the tax levy.

The City includes $2 million each year from the budget/tax levy for capital projects. That said, staff have a 2024 budget of $2.1 million against the levy, but they typically include projects in that figure council can modify or reject. That amount on that list for 2024 is $400,000. Council will have to resist overspending on this part of the budget because there is a surplus from 2023 in the capital tax reserve. This is because some projects were cancelled, or not done and put off to this coming or the next year because tenders were too high, and some projects were completed under budget.

Council will also spend some time reviewing the 10-year capital plan. They do this annually and the main purpose is to be aware of what projects need attention verses the shape of the reserve accounts (much improved over the last few years) and what other sources of funding staff have identified. In other words, staff try to not bring surprise spending to council (say, rebuild a sewage pumping station because of age and/or failure) in any given year and prepare a plan for maintenance, upgrades or replacement over time.

Items 2 And 3

There are two reports for council which are not budget related. The first is Orillia West Transportation Planning Study. This relates to the road network. Much of the land in the West Ridge is undeveloped, though council did approve a major subdivision this year, the Inch Farm subdivision is moving along and the province is about to start rebuilding the Highway 11 and the Highway 11/12 interchanges – again. All have an effect on traffic yet to be completely understood in the context of the entire west side of the city beyond Highway 11.

Staff are basically putting council on notice there will be a cost for the recommendations Tatham Engineering Limited identified in years to come. Staff want this included in the capital projects list and into the development charge background study. There appear to be no budget implications for 2024.

The next item is about speed. Staff want council to give authority to temporarily lower speeds in construction zones as needed – to include adjacent streets (detours). There are quite a few major road projects being planned and the cost implications come not from reducing the speed limits, but installing various things to force cars to slow down. If passed, this will go into effect right away. Staff say costs for speed reduction methods used will be factored into future road work projects.

Monday’s meeting is being held at the Opera House. It is open to the public or can be viewed on the City’s Youtube channel.

(Images Supplied)