Council Preview

By John Swartz

Orillia council has two special meetings Thursday, December 8 starting at 1 p.m.. One is about the 2023 budget. Normally this meeting is held in the summer before staff start working on their department budgets, but obviously input from the previous council may not match with what the new council thinks.

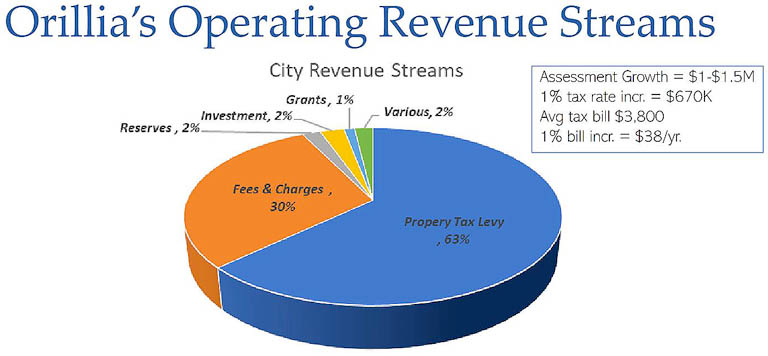

Among the key data points council will be given is Orillia’s estimated tax base grew by 1.5%, which translates to $1.5 million. About 66% of the operating budget revenue comes from property taxes, 30% comes from user fees – which includes water bills.

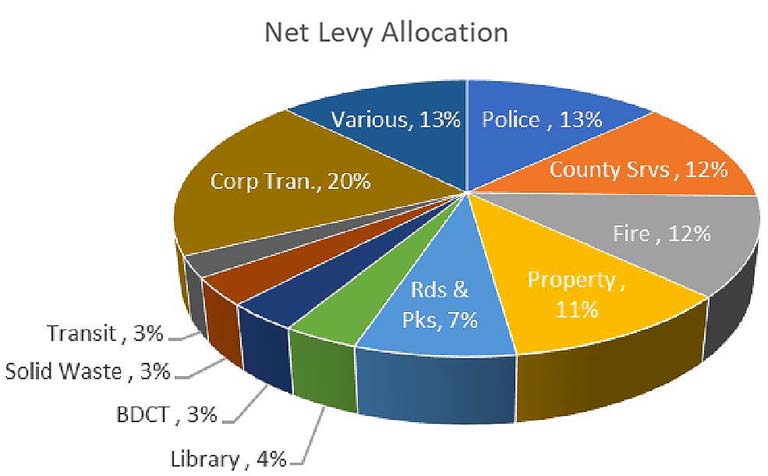

The bulk of expenditure (33%) is for wages and salaries of the 274 employees. Costs for policing, and social services contracted with Simcoe County take up 26% ($28 million). Paying for energy eats up $6 million (which would be a lot higher if the City wasn’t replacing things, like all the street lights). The City also collects taxes in the amount of $17.8 million which go into reserve accounts.

Staff warn council inflation will have a dramatic effect on the budget. One indicator, which never gets attention, is the construction index (non-housing) which is running at 15%; if you are building things, which the City does a lot of, materials and labour costs are obviously higher. Staff note they think any recession which may happen will be short lived because the unemployment rate is the lowest it has been in decades (5.1%). The key take away from that is any argument that uses ‘people don’t want to work anymore,’ is dead in the water as the words are uttered.

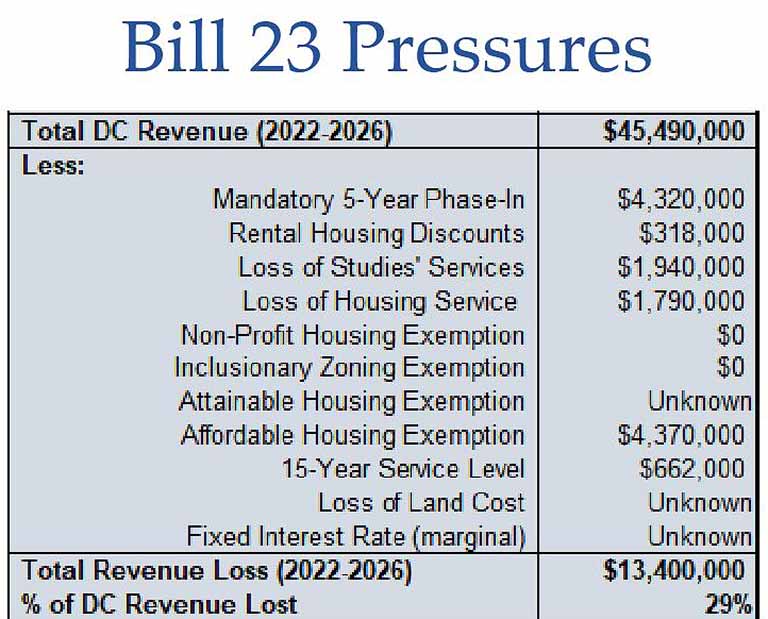

Of course the negative effects of Bill 23 are yet to be completely evaluated, but the initial impression staff has relates to lost development charge revenue. They estimate it, “to be in the range of $13.4M over the next five years,’ which will then come from the property tax levy (i.e. you) to pay for the necessary things new development demands of municipal infrastructures and previously paid for.

What they do know on that count is they are going to lose 1% of development charge revenue ($675,000) in 2023 from the County’s social housing program.

Also the City will be spending more for social services contracted to the County in other areas. The province’s continued degradation of long-term care and paramedic services takes an additional $707,999 out of the property tax levy in 2023. An $83,000 cut to children’s services will just go unfunded. This is balanced by a $231,935 drop in police funding because of grants. In all the social services portion of the budget will go up 6%. This is also mitigated by increasing use of reserves by $500,00 to almost $2 million total.

On the whole staff staff anticipates a property tax increase of 5 to 6 % because of causes outlined in the four previous paragraphs.

Capital Budget

The annual budget is divided between two groups, operating (wages, paperclips, and contacted services) and capital expenditure (construction, equipment buying, reserve contributions).

The 2023 capital budget includes building a road in the Inch Farm business park, reconstructing Laclie Street and Centennial Drive, Rotary Place repairs, and improvements to the waste water and sewage systems totalling $46 million. In all there are 100 new capital projects in the list for 2023. Then there’s the capital budget items already in progress which will come out of 2023 money. That totals $62 million.

Staff also update the 10-year capital forecast annually. Of course a good portion of the projected $547 needed for necessary projects comes from development charges. Fortunately the City has been rebuilding reserves and of all the projects identified there is only a $107 million shortfall in funding (some project funding sources are anticipated to come from funding programs from higher levels of government which are not yet reality).

In other words approximately 80% of the projects on the list the money is, or will be, available at the time it is needed (and most of those projects have 100% funding identified). It also means there are things on the list we know will need to be done, but have no idea where the money will come from, yet. The good news is it’s a 10-year plan, so there is time to figure those things out.

What Council Can Do

Of course, you can make good money betting council will not want to be responsible for property tax bills going up by 6% and very likely will set a lower target (but it likely won’t be as low as 2%. This is in order just to maintain services at the same level as 2022, 2021 and so on. That any increase is because of actions not created by council won’t matter to taxpayers, council will get the blame. Staff is naturally asking for direction on a budget target.

Staff advise there are only 5 options for council to take in order to reduce any increase. They are:

o User fee adjustments

o Cost cutting and efficiencies

o Adjust service levels

o Prioritize and defer requests and projects

o Further leverage capital debt financing

Then there’s the matter of priorities the previous and this council have for certain projects. Staff is asking for council’s advice on which should be the top 5 from a long list and how much funding should they carve out of the budget for those priorities. You will recall several councillors ran on doing something about the opioid, housing and doctor recruitment issues. Two of those are new and the doctor issue requires more money to meet promises. Expectations may have to be scaled back.

The Other Meeting

The second meeting council has relates to the municipal code and housekeeping amendments regarding vehicles for hire. There has not been a agenda posted at this time.

You can attend council meetings now, or watch them live on Rogers TV.

(Photos by Swartz – SUNonline/Orillia)