Council Preview

By John Swartz

The current council holds its last committee and regular meetings Monday beginning at 2 p.m. Originally Monday was to have a committee meeting only and the regular meeting next week. They changed this by notifying the public last week they intended to hold a special committee meeting, which allows them to set a different time other than the 4 p.m. normal start time and follow immediately with the regular meeting. The reason this is happening is because there isn’t enough business to conduct necessitating going one more week.

Three of the five items on the committee agenda are in the consent portion, which normally passes all together without discussion. One of the consent items involves the Orillia Rowing Club. At some point they will be vacating their Tudhope Park building and the plan is to move to City owned land on Pumpkin Bay where the Champlain Sailing Club operates. They would move into a building used in the past as an airplane hangar. The rowing club currently pays the City a token $1 as rent in Tudhope Park. The rent proposed by the City for the hangar is $5,000 per year based on market rates. The club notes the previous tenant only paid $1,800 annually and the club is asking council for a non-profit rate, presumably closer to their current expenditure.

The thing about market rates is they aren’t justified in a lot of cases by actual costs, they are simply what everyone else is charging for similar buildings and what renters are prepared to pay. Consider a mortgage free, already paid for dwelling/building with only property taxes, a fair return on investment and upkeep costs to account for and charging higher rent just because the people down the street with higher costs are charging more. It seems greedy, but that’s the system we accept.

City policy allows for the parks and recreation department to partner with user groups for programming and also allows for free, or reduced fees for using the City Centre; there are also other provisions for reduced fees in specified other City-owned facilities. Noting this seems to be staff’s way of saying council can decide to come up with a lower figure because, ‘it’s been done before.’ Staff appear to be suggesting council add this property to the short list of other properties that have lower, not-for-profit rates as a solution.

Doing so would allow staff to recommend lower rates, or for council to decide another amount for all the properties on the list (as current agreements come up for renewal).

Staff caution going piecemeal on a case by case basis would result in:

“The lease of real property at a below market value rate

represents a loss of

revenue to the taxpayers,” which along with as noted above, means we could get more even though there is no

cost justification. And,

“This approach provides little incentive for applicant organizations to seek outside funding to assist with their lease costs.” And,

“By discounting lease rates for particular groups, the City is essentially subsidizing their use of City property.”

Staff are proposing a change to policy relating to renting property in this manner:

“Any Lease of City Real Property to a Not-For-Profit Entity shall be transacted at Fair Market Value. Any difference between Fair Market Value and the Lease rate negotiated shall be calculated as a grant to the not-for-profit entity.”

So, if a community group has desire to make use of City facilities on a regular or permanent basis taxpayers are going to pay the difference between, say, what could be received if Walmart was interested and, in this case, what the rowing club has the ability to pay and still operate for the intended community benefit. This is an accountant view point where a cost is ascribed to something that won’t be forthcoming, and which won’t be forthcoming if a deal isn’t made. They never seem to take into account the intangible costs to the community by not having community groups fill gaps in needs.

It’s important to note this is regarding a building that has no costs other than maintenance to ensure it doesn’t fall down, and has no other use if not rented, or users identified, and therefore no other income potential. In other words, other than the perceived lost revenue of a market rate rental, there is little cost to the City to allow the rowing club to use the building, and if they don’t, they still get nothing.

A good question a councillor could ask is, “What does the City get if we don’t allow this group to use the building?” Of course the answer is going to be nothing.

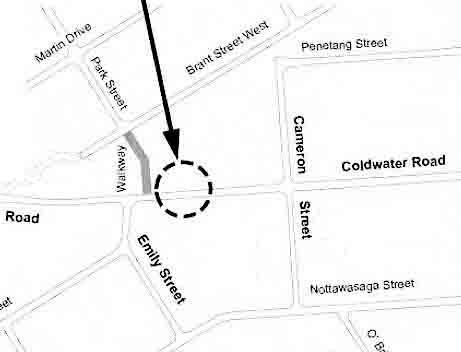

Crossing Coldwater

An enquiry motion from a year ago is getting to council, in time to let the next council take up the matter at budget. The request was for a report on the feasibility and costs to install a pedestrian crossover on Coldwater Road.

There is a path connecting Coldwater to Brant Street, which the report states is used enough to meet the criteria, but there is no way to cross to the opposite side to Emily Street (and bus stops).

While traffic counts also are in the range to qualify, staff also say it is in the middle of a hill and MTO traffic guidelines say crosswalks should not be located on hills where stopping distances are too short on the down slope. Therefore the best place to put a crosswalk is 45 meters away. The location is halfway between eastbound and westbound bus stops. The estimated cost to install a user operated crosswalk similar to that which is on Mississaga at the hospital is $30,000.

Transit

The next consent item is a report from two council requests. One is about the feasibility of having senior’s transit fare, and the other from Councillor Mason Ainsworth; in part –

“due to the significant increase in fuel prices, staff be directed to prepare a report on the options and opportunities that are available to increase ridership on the City’s transit system including potential programs/incentives/initiatives available via the cOnnect Transit Pass system, transit fare opportunities and increased marketing campaigns.”

Unlike many other transit systems, Orillia does not have different fares for specified groups (seniors, students). The City has paid an extra $240,000 in fuel cost this year to do its part in helping oil companies set record profits. The City also pays $1,665,000 in net operating costs beyond the contracted price of $2,750,000 to the operator; most of that is covered by grants and fares.

A marketing campaign is in place with the city using as much low cost (social media) and contra avenues (trading advertising on buses to media companies) as is available and staff say based on what other municipalities budget another $4,000 would be needed.

Staff recommend the issue of a marketing budget and fares be sent to the 2023 budget committee to deal with, with a suggestion fare increases might be in the wind. Fare increases would be at odds with the climate action plan, which hopes to reduce car use. Fare increases usually come with drops in ridership. Many European countries have free or negligible cost public transit, maybe it’s worth looking into how they do it.

Moving to reports, the City owns a lot on Benner Street where a radio tower is located. In June 2021 council requested the affordable housing committee report on the feasibility and cost to sever the lot in order to build housing.

The committee found the lot can be divided in a way that creates a lot suitable for 3 dwelling units and still be within zoning by-law regulations. If it is to be for affordable housing, rather than just put on the market for sale to anyone, the MPAC assessment value of $25,198 would have to be transferred from the affordable housing reserve to the land reserve fund. There would be a further $11,000 cost for legal and land preparation fees. However, the committee also notes a policy where any land the City sells has to be for housing first (except, obviously, in the industrial parks) and since there are no development proposals on the horizon there is no need to take any action right now.

Show Us The Money

The annual auditor’s report is next on the agenda. The City’s cash and investments increased by $38 million over 2020 to $113,568,616. This is because of a $18.9 million increase in reserves funds – a large portion of which is $10 million to the land reserve. Another $4.7 million accounted by developer fees and grants and $8.8 million budgeted but not spent on capital projects (delays because of COVID, or insufficient staff capacity)

The City’s revenue from taxation was $63,435,9639 (and as the incoming mayor, Don McIsaac, has said, just to do the same as last year is going to take approximately another $5 million because of inflation – though that may not all come from taxes) The City also received $1 million more than budgeted in grants, and $1.3 million more in charges to developers. User fees received were down approximately $2.9 million. The City’s total revenue was $101,309,794 – $1.3 million below budget.

At the same time expenses were $85 million, 3.7 million less than budgeted.

Regular Council Meeting

The only report is from the just concluded committee meeting. There is one motion from development services for council to approve the zoning by-law amendment for 175 Oxford Street (the housing development slated for the Regent Park United Church land) resulting from the public meeting October 3.

The consent agenda includes 13 grants committee requests. This is nothing extraordinary, council previously adopted a time table for those who annually ask for grants rather than having them dribble in all year long.

The council meeting can be watched live on Youtube.

The Inauguration of the new council happens November 21.

(Photos by Swartz – SUNonline/Orillia)