Orillia Power Corporation Ends Year Down

By John Swartz

There are many moving parts to understanding the financial statement the board of the Orillia Power Corporation (OPC) delivered to Orillia council Monday night, except for one thing bottom line profit or loss.

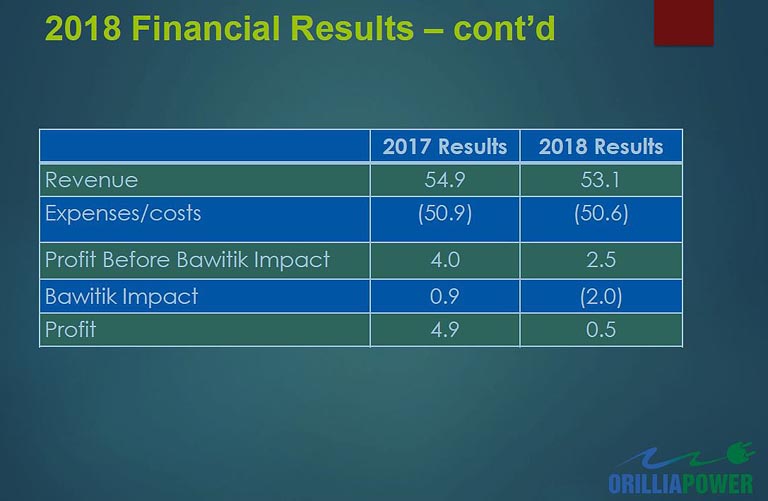

The OPC did not lose money, they had a $500,000 profit at the end of fiscal 2018, but compared to 2017’s $4.9 million it doesn’t look good. Because water levels were high at the right time 2017 was an exceptionally good year. The OPC’s three stations generated and sold more electricity into the grid than ever before, boosting earnings by about $2 million over average.

Had it not been for one thing, the 2018 results would have been about average, with a $2.5 million profit. So what happened? Doug Ford happened. Last July the Ontario government, without consultation, unilaterally cancelled 758 generation projects, 15 of those were hydro generation projects and one of those, the Bawitik Power Corporation’s generating station at Lock 25 on the Trent Severn Waterway (which OPC owns 75% of) was to start construction this year.

The government direction to the Independent Electricity System Operator (which awards contracts to buy electricity from producers like the OPC) to cancel contracts cost the OPC $2 million, and the loss is reflect in the 2018 financial statement.

“We were forced to look at our financial situation and write off our investment project. I can tell you the government will be paying us about $560,000 related to the cancelation of the contract. It’s nothing like the hit to the bottom line,” Greg Gee told council. Gee as chair of the OPC board conducted the annual shareholder meeting. Under the structure of the province’s electrical system instituted by the last conservative premier, Mike Harris, the OPC has only one shareholder and it is the City of Orillia.

The OPC and partners Shaman Power Corporation spent ten years planning and going through many levels of approvals and design to get to the stage where a license was issued in 2017, which meant construction could be scheduled to begin.

“We’re very disappointed,” Gee said.

Without the write off, 2018 was as normal as usual. Revenues (without the spike of 2017) and expenses were similar to other years. The profit, without Bawitik figuring in, would have been $2.5 million, “which would have been a pretty normal year for us. Two point five is about what we would normally expect,” Gee told council.

The OPC has two companies within its structure, a generation side and distribution. On the generation side it has three hydro generators (Swift Rapids, Minden and Matthias) as well as 7 solar generating facilities (4 in Orillia, 3 in Coburg), with a total generating capacity of 18 megawatts. Of course, the distribution side is all the poles and wires in town.

The station at Swift Rapids had a major rehab of the concrete structures in 2018, which necessitating shutting down production for a period of time. Of the three turbines at Swift Rapids, one is being refurbished in 2019. The Matthias plant is scheduled for a major refurbishment and engineering and planning will take place this year.

During the meeting councillor Dave Campbell asked if the turbine refurbishment would increase output. He was told that wasn’t likely because one plant is over 100 years old and the newest is 60 years old.

“It’s amazing the engineering that was done that many years ago is as incredible as it is because we are able to get little tweaks occasionally and little improvements in output. I’m amazed looking back at what they were able to achieve so many years ago when they didn’t have powerful computers and CAD drawings,” said Grant Hipgrave, president of the subsidiaries.

After the meeting Grant Hipgrave told SUNonline/Orillia some turbine parts had to be newly fabricated, but definitely not entire turbines.

“We were doing some turbine work on the Swift last year and you’re essentially rework everything, but we found there was one component, there was a crack in it. Then you’ve got brand new components there,” said Grant.

Gee added each plant is different and engineered to the specifics of the time.

“We have a series of different technologies at our different plants. You can’t just suddenly change over to a different technology,” Gee said.

The distribution plant is also continually upgraded. Those are expenses planned years in advance and ongoing. They are paid from retained earnings accrued each year.

“It’s not just why don’t we repaint, or do some upgrades. On the distribution side, if I can use that as a comparison, the OEB actually requires you to reinvest a certain percentage,” Gee said. On the generation side, “if you want to run those plants effectively over many years, you don’t want to let them slide.” Gee told SUNonline/Orillia.

The OPC board authorized a dividend to the City of $800,000. Sharp readers will recall the 2018 profit was $500,000. The difference was drawn from retained earnings.

“We just felt we knew the City, they have expectations,” Gee told SUNonline/Orillia. “They know that there are no guarantees, but they have expectations and we wanted to try and work with them as cooperatively as we could. It might be a bit of a stretch, but we didn’t want it to be that much of a fall in the dividend amount if we could help out,” said Gee.

Annual dividends are usually stable. In 2016 it was $1.1 million and every year has been a similar number, except in 2017 when a special and additional dividend of $250,000 was given because of the extraordinary profit. The City of Orillia factors the OPC dividends – and the annual interest payments (2018 $925,000) – into the municipal budget process. A $600,000 hit to the normally expected dividend amount would have been a problem, and it looks like the OPC board split the difference.

(Images Supplied)