Council Budget Preview

By John Swartz

Here we are, another year gone by and its budget time for Orillia council. Most of November will be consumed with talk about how much property taxes are going to go up and why.

November 4 is a regular council meeting date, and that meeting will follow a one hour overview of the proposed 2025 budget at 1 p.m. presented by the treasurer, John Henry. Previously council gave direction last June to staff regarding the parameters of a new budget, how much increase, they would tolerate.

The bottom line is staff are proposing a 6.94% increase. Council will likely do its best to conclude its examination, department by department, line by line, to a figure closer to 2%. Anything more than that will represent the largest tax bill increase in many years.

The largest driver of increase is from other bodies council has no control of, but have to pay for; organizations like Ontario Provincial Police, Simcoe County, and the Simcoe Muskoka District Health Unit. Their share of the increase is 5%, or $3.7 million.

The part the City has control of, staff and services shows a 1.9% increase, or $1.4 million.

If nothing changes, property tax bills will go up on average $280. To get a better sense of what you will pay, the increase is $92 per $100k of assessment.

The dollar amount of the over budget increase is $5.91 million. In previous years this figure has been lowered by additions to the tax base, property development, which added more than $1 million annually to the City’s tax revenue. However, the additional amount added by new development in 2024 is only $850K.

The prime instigators for such a large increase are the outside services.

The OPP submitted a budget 25% higher than 2024. This will bring their total share of tax dollars to $11.6 million.

The county provides social/affordable housing ($3.5 million), Ontario Works ($1.1 million), long term care ($3.3 million), children’s services ($643K), and paramedic services ($2.5 million) to the City. The County is asking for $1.3 million more across those services for a 14% increase.

These entities don’t have to answer to Orillia tax payers. The health unit is asking for a more reasonable 2% increase of $10K, or 2%.

The bottom line is, paying for those increases the City has little control over and must pay according to provincial regulation, means staff has to keep greater control of the day to day areas of spending they propose to do. This is why council has to say no to some worthwhile project proposals and things like our roads having, let’s call them rough patches.

Inside City Hall

Aside from property taxes, the city gets a significant portion of its revenue from fees and charges. Buried in the report is the expectation speed camera revenue is estimated to be $500k. To some, fees, charges and tickets could be viewed as just another form of taxation.

Labour costs account for 43% of the budget, Reserve contributions another 26%. The City adopted a n investment strategy several years ago (where the ongoing float, some reserves, etc. are parked) and accounts for 17% of revenue income.

The actual amount of spending is split between labour and service cost at 58%m and capital projects at 30%. When one looks at the balance sheet the capital portion of the levy increase looks significantly lower each year because grants from other levels of government and contributions fro reserves for project costs take up the lion’s share of the city’s annual capital spending.

Central to the City’s capital spending is the 10-year capital plan. A dozen years ago the City didn’t have one. this was an exercise in getting a handle on cast of things like the timing of road reconstruction, fleet replacements, building maintenance, upgrades and replacement and comparing how to pay for them. At this point in time staff estimate the forecast of reserves will still be short $255 million by 2034 to pay for everything on the list. The antidote is an increase in reserve contributions of $2 million from the proposed budget. One could do the simple math and see this does not add up. Staff also consider grants from other levels of governments (which can change) and other sources of revenue.

Water In, Out, and Not Asked For

Not included in your tax bill is the cost of operating the City’s water filtration, waste water treatment and storm sewer systems. The amount charged and collected has to completely pay for those things according to provincial regulation, and reserves need to be collected for maintenance and upgrading of the City’s systems. Parking is included in this section of the report, but accounts for relatively little compared to water expenses because revenue largely comes from parking meters.

Expenses are forecast to go up by 9% for water, 16% for waste water, and %27 percent for storm sewers.

The Capital Budget

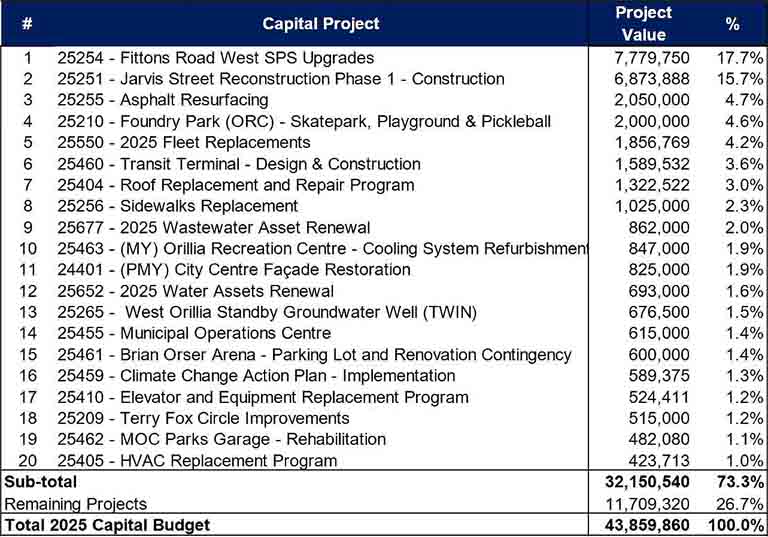

Staff say capital spending is going down considerably from previous years to $43.9 million for 109 projects. See the chart for major projects on the horizon.

Reserves will be the source for $25 million of the budget. The City is planning to finance the Fittons Road, Jarvis Street, and transit terminal projects to the tune of $11 million. The rest will come from development charges and, as is traditional, $2 million from the current tax levy.

Of special note, phase 3 and 4 of the Laclie Street project have been delayed by two years. Phase 3 was supposed to happen in 2025, but will not start until 2027 now. SUNonline/Orillia understands the utility relocation planning and execution, for which Rogers, Bell and Hydro One have had 5 years to map out, is not finished. Your shock absorbers on your car will be happy to learn that.

Council will meet November 5 and 6 this week, and November 12 and 13 next week. The formal adoption of the 0225 budget will happen at the December 9 council meeting.

You can watch the budget overview as it happens on the City’s Youtube Channel.

The preview of the regular meeting is under a separate title.

(Photos by Swartz – SUNonline/Orillia)