Editorial: About The Carbon Tax

By Fred Larsen – Special to SUNonline/Orillia

Like most of you, I’ve been reading a lot of what people have been saying about the Carbon Tax, especially in ads which call on us to Axe The Tax. Many people seem convinced of the following:

- That carbon pricing is a “tax grab.”

- That it’s responsible for recent rises in prices and therefore affects the “affordability” of day-to-day life

- That it’s the main cause of rising gas prices,

- It simply doesn’t work.

But experts say none of these claims—not even one—is true.

One group of experts, economists, have taken the time examine how the carbon pricing program works, what it costs, who pays the most, who pays the least, and whether it’s working. Most importantly, they include the rebate in their analysis. The rebates are the cheques that the Canadian government sends to those Canadians subject to the carbon pricing program every three months. The rebates are intended to offset the amount Canadians are paying for the carbon pricing on gasoline, diesel, natural gas or propane.

Quarterly rebate payments go out to every tax-filing adult household in the eight provinces where the federal carbon tax applies. The amount of the rebate is tied to family income, so lower- and middle-income individuals and families may receive more. We receive back 90% of the money raised by the carbon pricing program. The other 10% goes to help rural and northern residents across Canada, especially farmers who have to use a lot of gasoline and diesel in their large machinery and trucks.

The purpose of carbon pricing is to motivate Canadians to use less gas, less diesel, less natural gas and propane – less fossil fuels overall – because it’s fossil fuels we have used for the past 150 years or so that are messing up the climate. Hardly anyone doubts that anymore.

What do those experts say about carbon pricing?

First, they say it’s the most efficient and lowest cost way to try to bring down fossil fuel emissions. It’s transparent. We know what we’re paying and, if we don’t like paying that extra money, we can try to use less gas, less diesel, less natural gas. We can use the car less, buy a smaller one, maybe even buy an electric vehicle, a scooter or a bike. For our homes, we can change to a heat pump and get off gas. In the process of using less, we’ll reduce the emissions that are going up into the atmosphere. That’s a good thing. In fact, that’s the whole purpose behind carbon pricing. If we don’t want to pay more, then we can take action to reduce our fossil fuel use and the pollution it causes.

Second, it’s not a main cause of inflation. Most people are getting more back in the rebate than they pay in the extra cost of oil and gas. People who don’t have a car, who take the bus or bike or walk to work are really ahead because they’re not using gasoline at all. The experts have responded to the loud cries like “the carbon tax is making everything unaffordable,” by pointing out that even the most recent rise in the carbon pricing is responsible for just 0.15% of this year’s rise in inflation. They estimate that the carbon price, over its lifetime, will contribute to just a 0.6% increase in the cost of living.

The estimate is that 80% of Canadians are getting back more than they pay out for transportation and heating costs. The 20% who don’t are in high income brackets and usually spend more on pollution (bigger and more cars, bigger houses, cottages, more toys, etc.)

The third—and most important—point these experts agree on is that the carbon pricing program works. “Since federal carbon pricing took effect in 2019, Canada’s GHG emissions have fallen by almost 8 percent, although other policies were also at work. A new report from the Canadian Climate Institute shows that federal and provincial carbon pricing, for industries and consumers, is expected to account for almost half of Canada’s emissions reductions by 2030.”

The reason carbon pricing works is simple: when something costs more (i.e. fossil fuels), most people try to use less of it. That is basic economics and common sense.

In an open letter of March 28, 2024, over 300 economists from across Canada make the following statement: “[T]he evidence shows the price-and-rebate approach provides an incentive to reduce carbon emissions (due to the price), while maintaining most households’ overall purchasing power (due to the rebate).

In short, carbon pricing is the least-cost way to reduce emissions, drive green innovation, and support Canada’s transition to a clean and prosperous economic future.”

So there it is. While some of our elected leaders are loudly proclaiming that carbon pricing is what’s wrong with everything in Canada these days, those who really study the program say it isn’t. It’s working and it’s not costing the economy much. Most people are coming out ahead of the game because of the rebate.

When people lower their demands for fossil fuels, say, by replacing that natural gas heater with a heat pump, or by driving less, or by choosing to buy an EV or a hybrid- anything that uses less gas – they will pay less of the carbon pricing as it goes up. Their rebate will be extra money while they are helping to lower Canada’s carbon emissions.

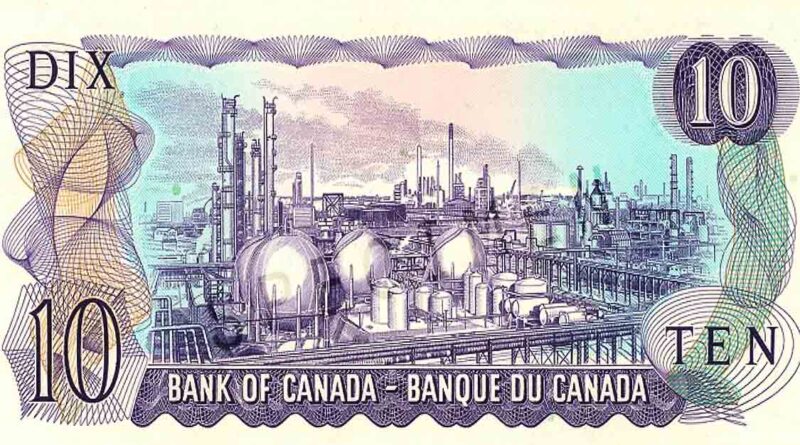

(Images Supplied) Main: Oil Refineries in Sarnia’s Chemical Valley as depicted on the $10 bill.