Council Preview

By John Swartz

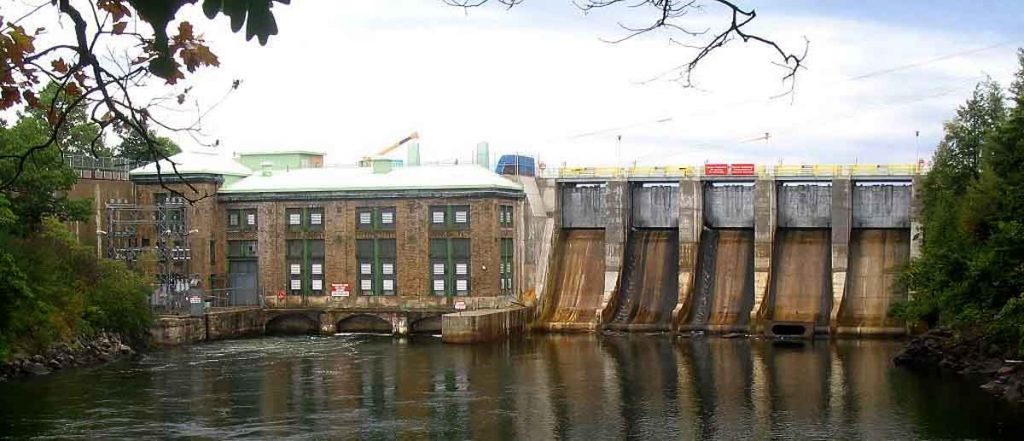

The Orillia Power Corporation will deliver its annual year end statement to council Monday afternoon at 2 p.m. The City of Orillia is the only shareholder. As is expected each year, the amount of money transferred to the City is of prime interest of taxpayers.

The results for 2019 are not as good as other years when more than $2 million in total is usually transferred. For 2019 OPC paid $800,000 in dividends (on 2018 results) and $925,000 interest on the $14 million loan from the City established when OPC was created. The 2020 dividend will be $1.2 million.

The driving factor for how much is paid to the City in dividends each year is income from OPC’s generating operations, not from the distribution side which is fairly consistent year to year, and not subject to wide fluctuation. Revenue from hydro generation increased in 2019 to nearly $8 million from 2018’s $6.5 million. Solar generation also increased marginally.

![]()

Notes to the financial statement reveal how OPC is preparing for this year’s operation. It states the Ontario Energy Board imposed a disconnection ban on all utilities until July 31 and lower time of use rates. The report also states power consumption declined significantly and increased delays in receivable payments. Revenues from the generation side of the company have not been affected.

The sale of the distribution business to Hydro One is also addressed. New information is the closing date of the sale, which will be September 1, 2020 with a transition period of 6 to 9 months when assets and liabilities will be transferred to Hydro One and operations and employees will be moved over.

Before closing date, OPC will transfer to the City properties involved, and repay a promissory note of $9,726,000. The sale price of the shares is $26,350,000 and is subject to closing adjustments and with the current year end figures, the adjusted sale price is expected to be $29,991,000.

In the end, after all accounting for revenue and payments of all kinds are included, the net operating profit of the OPC for 2019 is $820,000 on total operating revenue of $56,260,000.

While the shareholder meeting is an annual public affair, because meetings have been held by video since the emergency was declared council chambers are closed. Rogers TV will not be televising council until 4 p.m. when the committee meeting starts, however a recording of the OPC meeting will be available on the City’s website.

Committee

There will have been a closed session prior to the public meeting (noon) and there may be some motions from that brought to committee. The closed session agenda includes items regarding 2 Hunter Valley Road, the union contract with environmental services staff, recruitment of a general manager for corporate services/city solicitor, and notice of a staff retirement.

The treasury department has a report outlining a request the City issue a debenture of $2.4 million and authorize $5,000 in legal fees for a complete upgrade of street lighting to LEDs with SMART controls.

Some might think, here we go again, more debt. The notes in the report are instructive on the City’s current debt position.

The province regulates how much debt a municipality may take on. Municipalities cannot borrow for run-of-the-mill expenses and can only borrow against bricks and mortar projects. Current external debt on a $20 million debenture from 2021 is $6 million and will be paid in October 2022.

The regulating device is a municipality’s ability to repay, which the province limits to 25% of annual operating fund revenues, or in Orillia’s case $20 million. Orillia would be able to borrow up to $266 million in this case, but, as noted has only $6 million outstanding. The cost per capita for the City’s current debt is $224 annually. The provincial average of municipalities with debt is $758.

Staff is recommending borrowing the $2.4 million through Infrastructure Ontario at a rate of less than 1.59%.

Two other options, with TD Bank (includes 4 vehicles) or using cryptocurrency are included for discussion, but higher interest rates are likely to be incurred, so those options are not recommended.

Councillor Tim Lauer has three enquiry motions on the agenda. He would like staff to report on the feasibility of amending the winter control policy to prioritize sidewalk snow plowing to one side of streets which have sidewalks on both sides.

He would also like a report on the idea of funding the City’s development charge reserve account with external financing. This is different from the borrowing matter above. The City has been borrowing from some reserve accounts to pay for capital projects. It’s like taking the new car you haven’t bought money and spending it on a bus, with the idea you’ll pay back the money for the new car. The development charge reserve shows a negative balance currently.

Lauer also wants a report on hiking littering fines. No documentation was included in the agenda to support Lauer’s requests.

![]()

Regular Council Meeting

The regular council meeting, normally held a week after committee meetings, follows. Other than ratifying the committee meeting actions and the OPC Dividend, there are no other new items.

(Photos by Swartz – SUNonline/Orillia)